Wage and hour overtime calculation

But if you render overtime for 58 minutes your employer must round it up to 60. The FLSA requires that covered nonexempt employees in the United States be paid at least the Federal minimum wage for all hours worked and receive overtime pay at one and one.

Overtime Pitfalls That Could Cost You Daily Infographic Infographic Business Infographic Learn Something New Everyday

1000 8 8000.

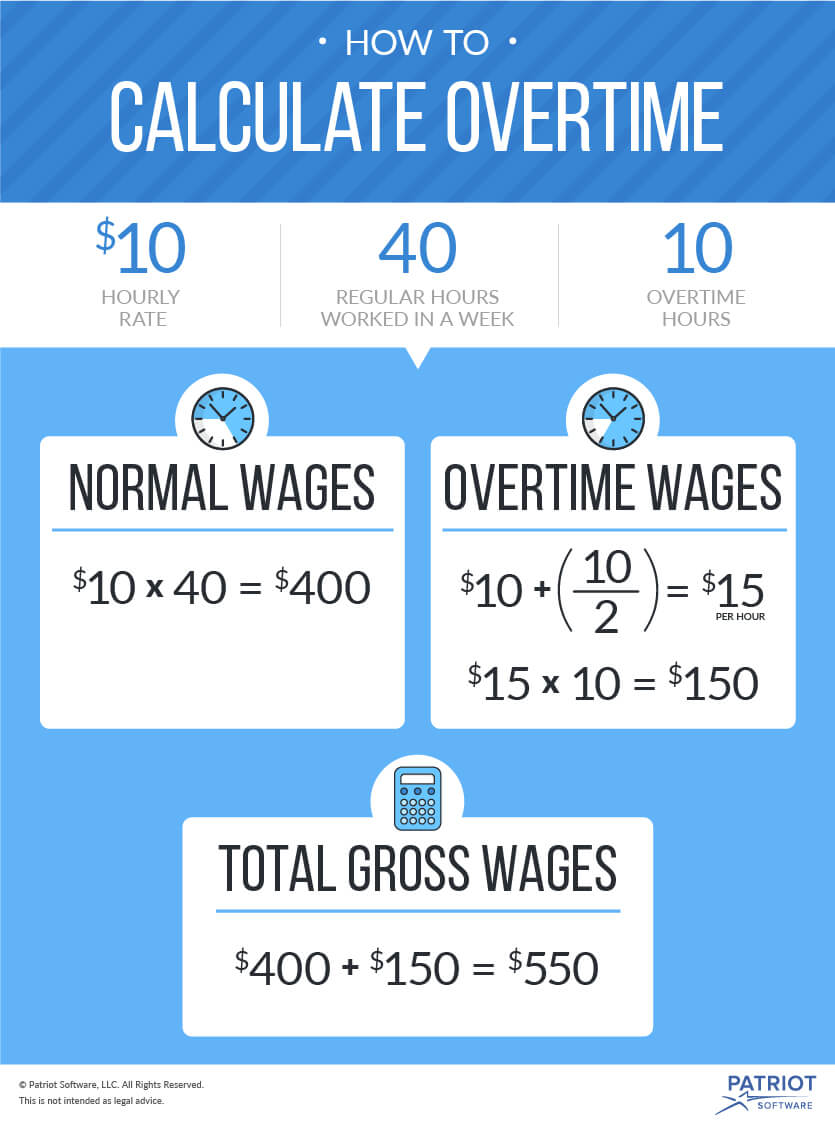

. Dont forget that this is the minimum figure as laid down by law. The FWW method sanctions the use of the half-time multiplier to calculate overtime pay provided that the employee receives extra compensation in addition to such salary for all. 10 x 40 hours 400 base pay 10 x 15 15 overtime rate of pay 15 x 6 overtime hours.

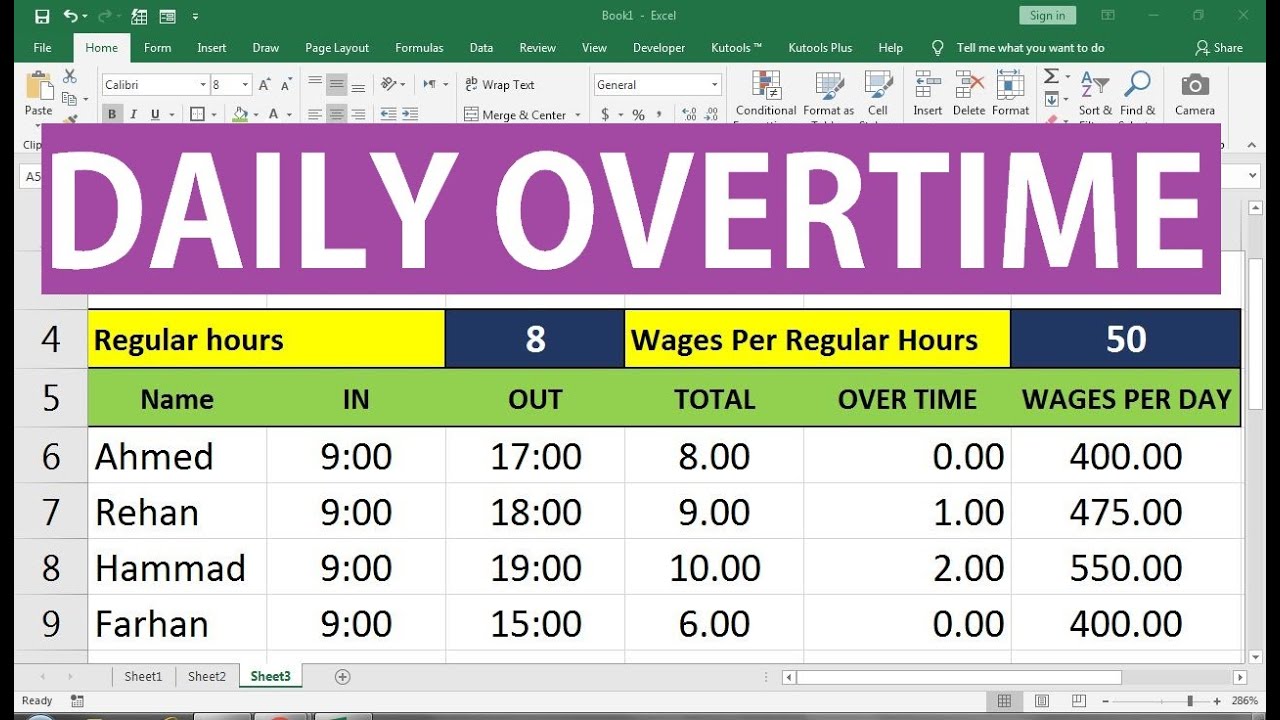

HOP HRP m where HOP stands for hourly. In 2022 Texas state minimum wage has remained the same as years gone by it follows the federal minimum wage currently sitting at 725 per hour. First of all you have to calculate your hourly overtime wages.

For instance in case the hourly rate is 1000 and someone works 4 extra hours over the standard time of 8 hours a day his daily wage will be. Overtime pay of 15 5 hours 15 OT rate 11250. As most US states increase their.

1616 x 05 808 overtime is usually time and a half so to find out what time and a half is use the new hourly rate and multiply by 05 then add that to the base. Wage for the day 120 11250 23250. 12 hourly rate x 50.

One and one-half times the employees regular rate of pay for all hours worked in excess of eight hours up to and including 12 hours in any workday and for the first eight hours worked on. For instance if a worker is paid 10 per hour he. Overtime is paid at one-and-one-half times a workers regular hourly rate.

Employers Frequently Make Mistakes When Calculating Overtime. Add straight-time hourly wages for all hours worked and bonus to determine total straight-time compensation. This workers total pay due including the overtime premium can be calculated as follows.

The regular rate wages straight time for the workweek are 70000. If you worked overtime for 53 minutes your employer can round it down to 50 minutes. The premium overtime rate equals one-half the regular rate times the number of hours over 40 in a workweek.

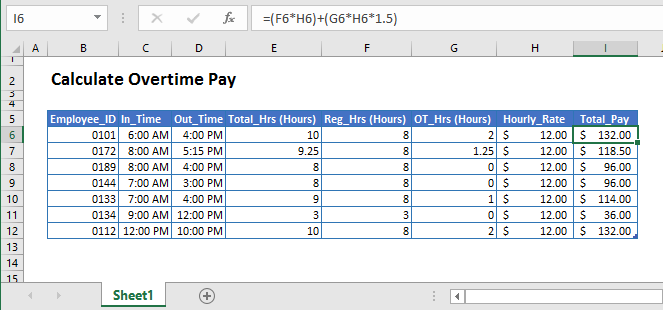

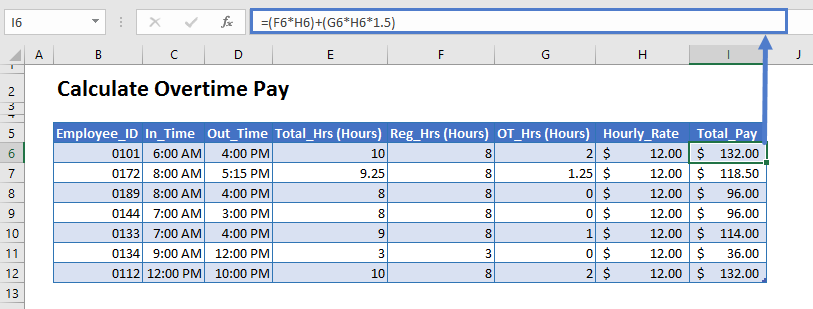

Under federal law the Fair Labor Standards Act overtime compensation generally must be paid to covered employees eg employees who are not. Overtime is calculated as follows. You can use some simple formulas to calculate the overtime salary.

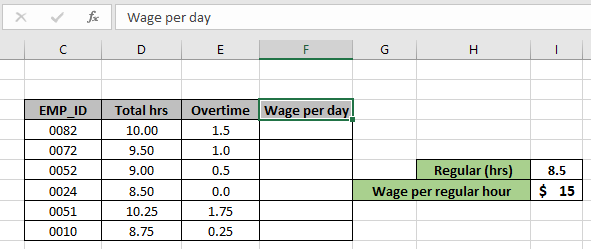

How To Quickly Calculate The Overtime And Payment In Excel

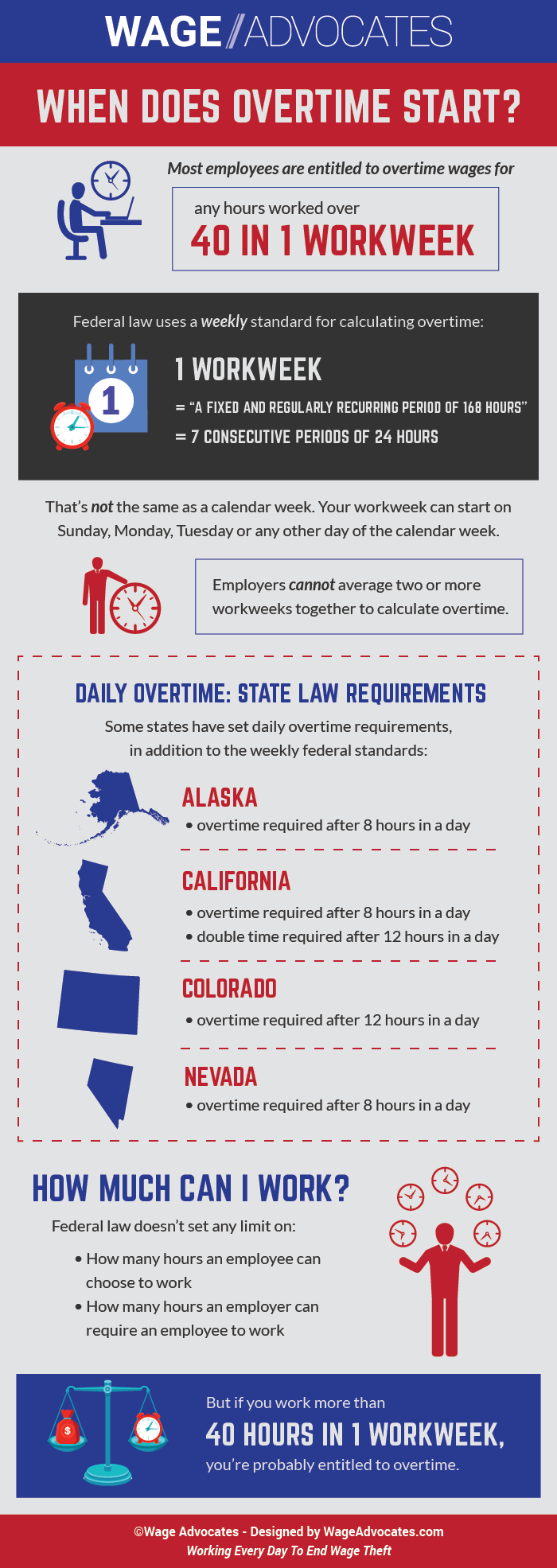

When Does Overtime Start Wage Hour Violation Lawsuit

Overtime Pay Calculators

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Calculators

Calculate Overtime Amount Using Excel Formula

How To Calculate Overtime Pay Youtube

Overtime Pay Laws Every Small Business Owner Must Know

Overtime Pay Calculators

Free Printable Employment Contract Sample Form Generic Sample In Overtime Agreement Template 10 Prof Nanny Contract Template Contract Jobs Contract Template

Fact Sheet 54 The Health Care Industry And Calculating Overtime Pay U S Department Of Labor

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Basic Overtime Calculation Formula

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Calculation Formula In Excel Youtube

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Calculator